By:Emmanuel Mayah, Kayode Adegboyega, Doris Chizoba And Ginika Nnabue

-“Over N30 Trillion federal revenue stolen by Port Mafia”

By Emmanuel Mayah, Kayode Adegboyega, Doris Chizoba and Ginika Nnabue

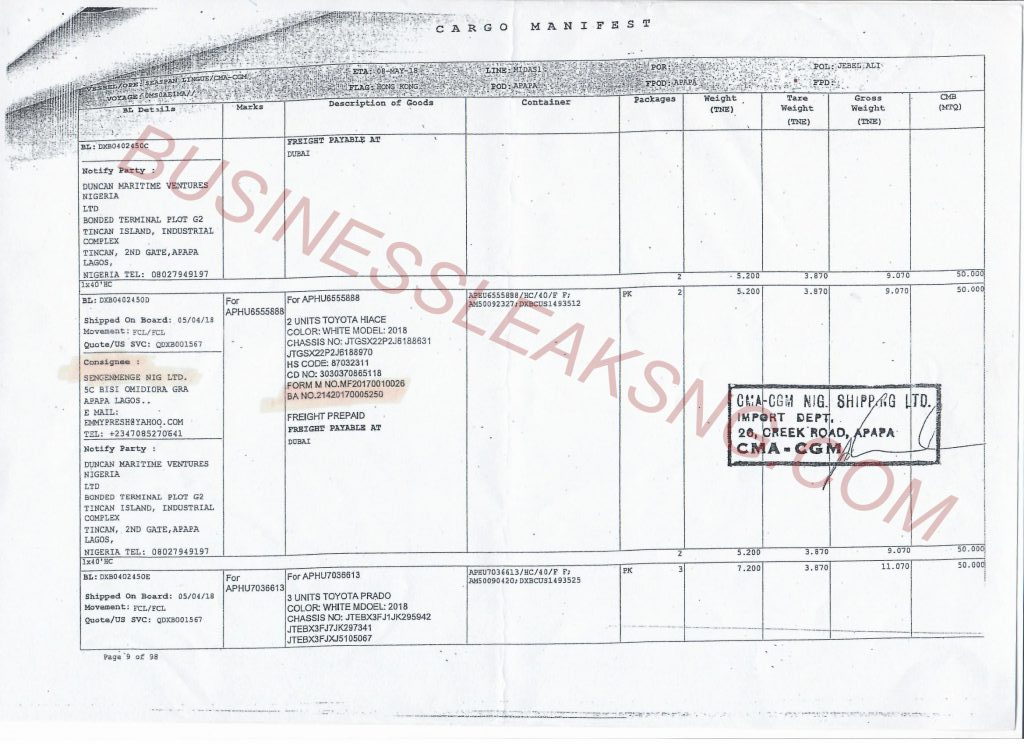

Large-scale fraud in the Nigeria Customs Service appears to be taking a turn for the worse as a total of 17 companies are discovered to have imported millions of dollars worth of luxury vehicles, many of them armoured, into the country using just one Form M.

BUSINESS LEAKS has been following the paper trail of some high-flying and politically-connected business owners widely regarded as enablers of organized crime activities in Nigeria’s maritime sector. The transactional footprints of this tribe of operators became a matter of grave concern, so much so that back in 2017, an alarm was raised on the floor of the Nigerian Senate.

That year, the Senate’s Joint Committee on Customs, Excise and Tariff raised the alarm on the activities of people it described as “Port Cabal” which it said had “swindled Nigeria of over 30 trillion naira in recent years”.

Documents gathered by BUSINESS LEAKS show that between 2017 and May 2018, a total of 554 luxury vehicles were imported by the 17 companies using the same Form M No: MF 20170010026.

The luxury cars included one Rolls Royce, 84 Toyota Landcruiser, 41 Toyota Fortuner, 123 Toyota Prado, 46 Lexus 570/460, 140 Toyota Hilux, 32 Toyota Camry, 21 Toyota Coaster, 43 Toyota Hiace, 21 Mitsbushi Pajero and 2 Range Rover. The vehicles, targeted at high-end market, were the newest brands for the years they were imported – 2017 and 2018. What more, most of them were armoured. Among the import documents sighted by BUSINESS LEAKS, there were no End-User-Certificates from the office of the National Security Adviser (NSA). Permission in the form of End-User-Certificate is a pre-qualification for importation of armoured vehicles into Nigeria.

While looking into the activities of the Customs, financial leakages and malpractices in the nation’s ports and revenue system, the Senate Joint Committee had in 2017 said: “a group of unpatriotic persons brazenly constitute themselves into a cabal to inflict infractions at the nation’s sea ports.”

The Committee had added that the infractions had become daily occurrence just as it accused commercial banks, shipping companies, terminal owners and operators of colluding with officials of Nigeria Customs Service and Nigerian Ports Authority (NPA) to defraud the country in trillions of naira and inversely constitute a clear and present security threat to our nation.”

Investigations revealed that infractions at the seaports and airport cargo terminals come in various forms including Form M racketeering, the abuse and violation of foreign exchange issued by the Central Bank of Nigeria (CBN), incorrect classification and under valuation of consignments coming into the country.

What is Form M?

Form M is the most important item in the documentation process put in place by the Federal Government of Nigeria through the Central Bank of Nigeria (CBN) and the Nigeria Customs Service (NCS), to monitor goods imported into the country as well as to enable collection of import duties where applicable.

Any person intending to import physical goods into Nigeria must initiate the importation by processing a Form M through an authorised dealer (licensed bank). Alongside the Form M, a host of other documentation will be presented to the bank. Where approved, the Form M serves as authority to the bank to open letters of credit for foreign exchange transactions on behalf of the importer.

This form has a unique number which must be quoted/written on all the shipping documents; although there are exemptions such as Diplomatic cargos (of reasonable quantity), personal effects, goods shipped in by government agencies or goods shipped into Free Trade Zones in Nigeria such as the Calabar Free Trade Zone (CFTZ).

Form M is the first official document needed to initiate shipment to Nigeria. The life span of a Form M is 6 months (for general merchandise) and one year (for plant and machinery), after which an extension of 6 months (for general merchandise) and one year (for plant and machinery).

A Form M is usually issued for a particular supply contract (between the oversea manufacturer and the Nigerian importer) and allows for part shipments within the validity period. For large project such as stadium construction, a Bulk Form M can be issued, which allows continuous part shipments throughout the validity of the Form M.

Form M is a form of licence. Approval of a Form M depends, among other things, on the forex approved for the importer by the CBN for a particular import. To obtain Form M, the importer must present his Tax Identification Number (TIN). In fact, the TIN is now key-username to log into the electronic platform to process this all-important document. Form M is not transferable from one importer to another. And a Form M approved for the import of a particular item cannot be used even by the same importer to bring in a different item.

The 17 companies

The 17 companies that managed to beat the system, clone and utilize Form M No: MF 20170010026 to bring in their different consignments, instead of obtaining 17 different Form M with 17 different tax identification numbers are:

1.Sengenmenge Nig. Ltd

2. Marko Nig. Ltd

3. Brasslet Nig. Ltd

4. Offor & Son Nig. Ltd

5. Lext Vin Nig. Ltd

6. Modul Oil & Gas Limited.

7. Supulus Nig. Limited

8. Zeb Holdings Limited

9. Amaju & Son Limited

10. Vintage Nig. Limited

11. Joneble Holding & Sons Limited

12. Kaslak Nig. Limited

13. Handhoast Limited

14. Ruffo Nig. Limited

15. Auto Creation E-Hub Limited

16. Sonnex Nig. Limited

17. Emy Cargo and Shipping Services.

Speaking on the issue of the Form M, Mr. Ojerinde Solomon, an importer at PTML container terminal said he had serious doubt if a Form M is transferable to another importer or consignments “because each consigned goods has its own Form M.”

Anti-corruption campaigner, Olalekan Akande, expressed his shock to BUSINESS LEAKS that the systems of the Nigeria Customs Service did not detect the cloned Form M.

“There are many things involved here. Is it that the 16 other companies do not have tax identification numbers to process their own Form M or is it that they were unable to get forex allocations locally to import and then resorted to using their funds overseas to bring in goods but do not know how to explain their sources of the forex to CBN to get approval for Form M? We might be dealing with a huge case of money laundering here,” Akande said.

Under the Forex Restriction Guidelines, any importer that intends to finance imports using funds from overseas is required to submit a written confirmation from the authorized dealer on the source of funds, and evidence of the source of funds, before a Form M can be issued. This is to check money laundering and terrorism financing.

(to be continued)

This investigation was carried out under the Collaborative Media Engagement for Development Inclusivity and Accountability Project of the WSCIJ, with funding from the MacArthur Foundation.

Source: Satellite Times